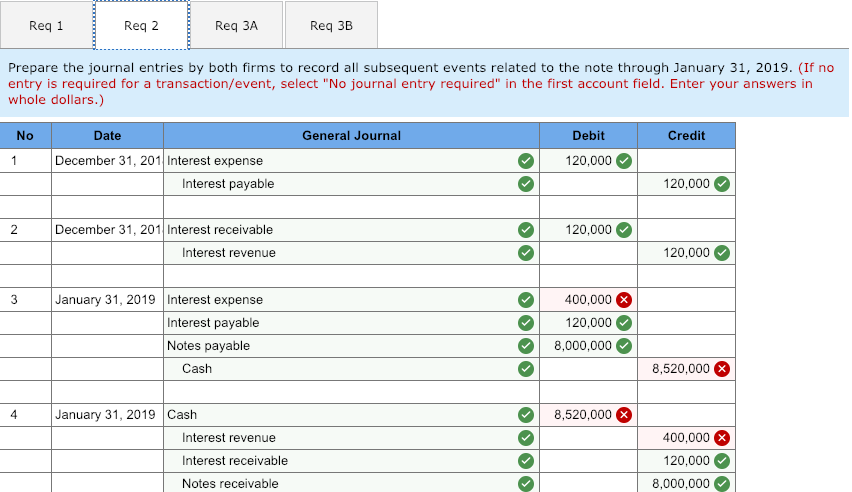

This journal entry is made to eliminate the liability that the company has recorded previously for the interest on borrowing money. Journal Entry for Loan Taken From a Bank.

Recording Transactions Using Journal Entries

The purchase of inventory payment of a salary and borrowing of money are all typical transactions that are recorded in this manner by means of debits and credits.

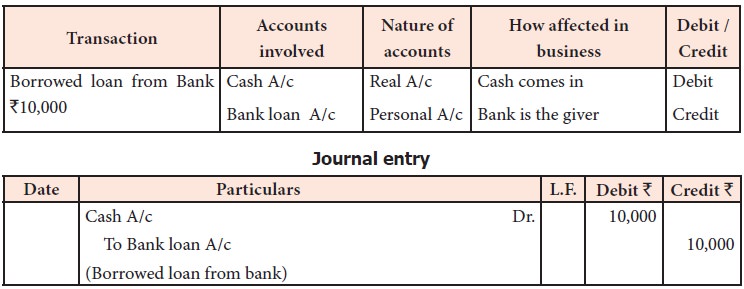

. Answer 1 of 6. All journal entries are maintained within a journal. How to record a loan if a business receives a loan of 10000 from a friend of the owner and the money is paid direct to the bank account.

This topic has 9 replies 4 voices and was last updated 5 months ago by P2-D2. Debit what comes in and credit w. Borrowings Entity A borrowed 20000 from a bank and received the full amount in cash.

This example is based on the purchase of a car from a car sales business which business signs you up with a loan provider. Banks and NBFCs are an integral part of an economy as they act as a support for companies by providing them additional cash leverage in the form of loans. It is a way to finance cash flows for a business that otherwise finds it difficult to secure a loan because the assigned receivables serve as collateral for the loan received.

Forums Ask ACCA Tutor Forums Ask the Tutor ACCA FR Exams Journal entries for borrowing cost capitalisation. Go to Accounting Journal Entry New Journal. Example 1 Borrowing money journal entry.

The first example is a complete walkthrough of the process. The best way to master journal entries is through practice. Journal Entry when the loan is sanctioned.

The timing of recognition is especially important in connection with revenues and expenses. Create Dev Co. Create account for bank if not exists.

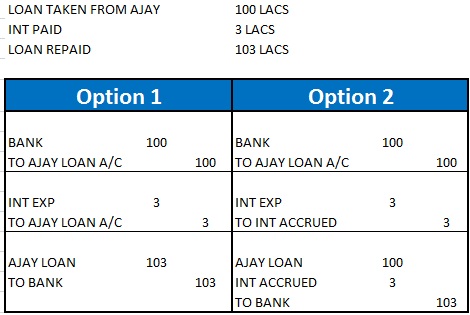

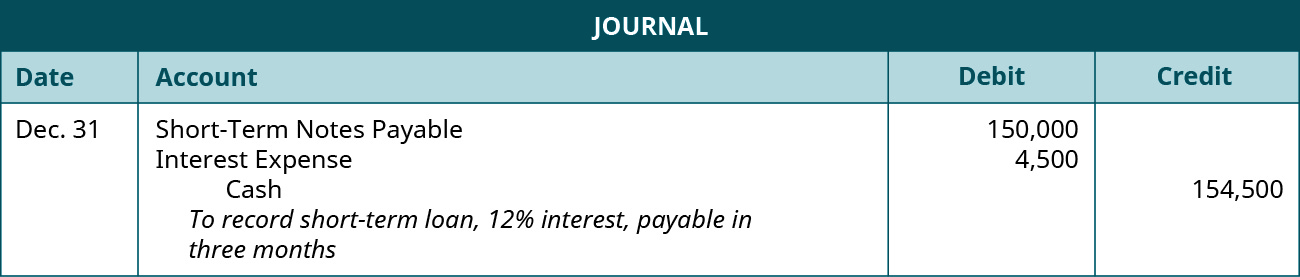

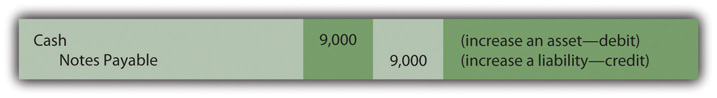

Journal entry for payment of borrowing money When the company makes the payment back to the creditor or the bank for the borrowing money it can make the journal entry by debiting the loan payable account and crediting the cash account. Record the interest expense. The journal entry used to record the issuance of an interest-bearing note for the purpose of borrowing funds for the business is.

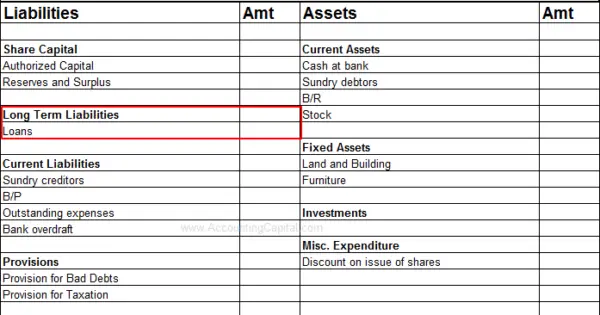

Such a loan is shown as a liability in the books of the company. Journal Entry Examples. Future and present value tables.

See the answer See the answer done loading. Typical financial statement accounts with debitcredit rules and disclosure conventions. -- Increase in Liabilities Example 3.

Post Journal entry at the time of loan repayment. Time Value of Money. ABC Company borrowed 300000.

Prepare a journal entry to record this transaction. Similar to accrual or deferral entry an adjusting journal entry also consists of an income statement account which can be a revenue or expense and a balance sheet account which can be an asset or liability. To learn more launch our free accounting courses.

Provide Bank name in NAME and select Bank account under the Group dropdown. Receives sum of amount. A set of accrual or deferral journal entries with the corresponding adjusting entry provides a complete picture of the transaction and its cash settlement.

When loan is received by borrower. More Examples of Journal Entries Accounting Equation Double Entry Recording of Accounting Transactions Debit Accounts. Includes financial and managerial terms.

Purchase of Car Journal Entry. As per the rules Debit the receiver Credit the giver Here bank is giver Bank loan would be credited. Examples of journal entries for numerous sample transactions.

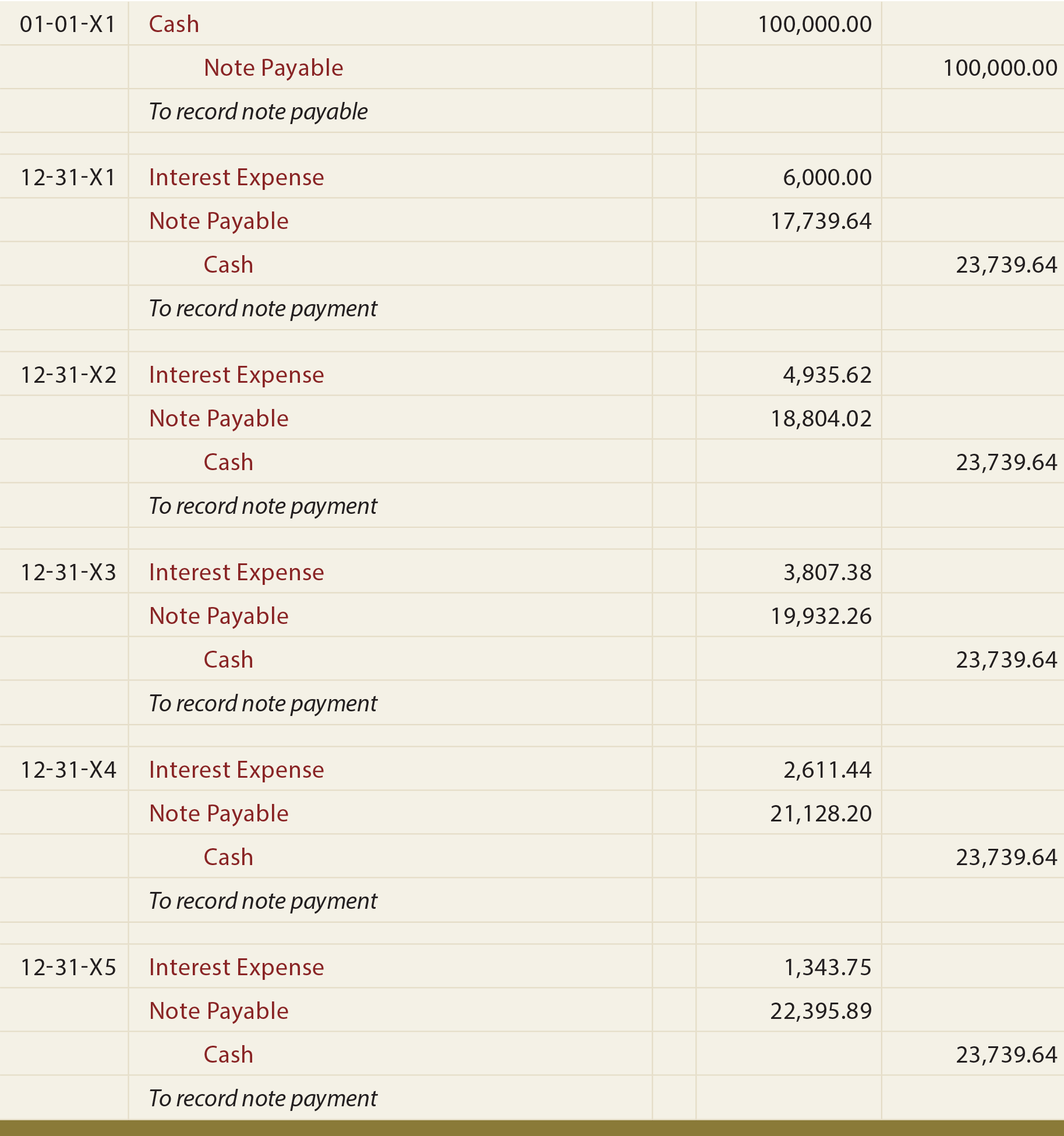

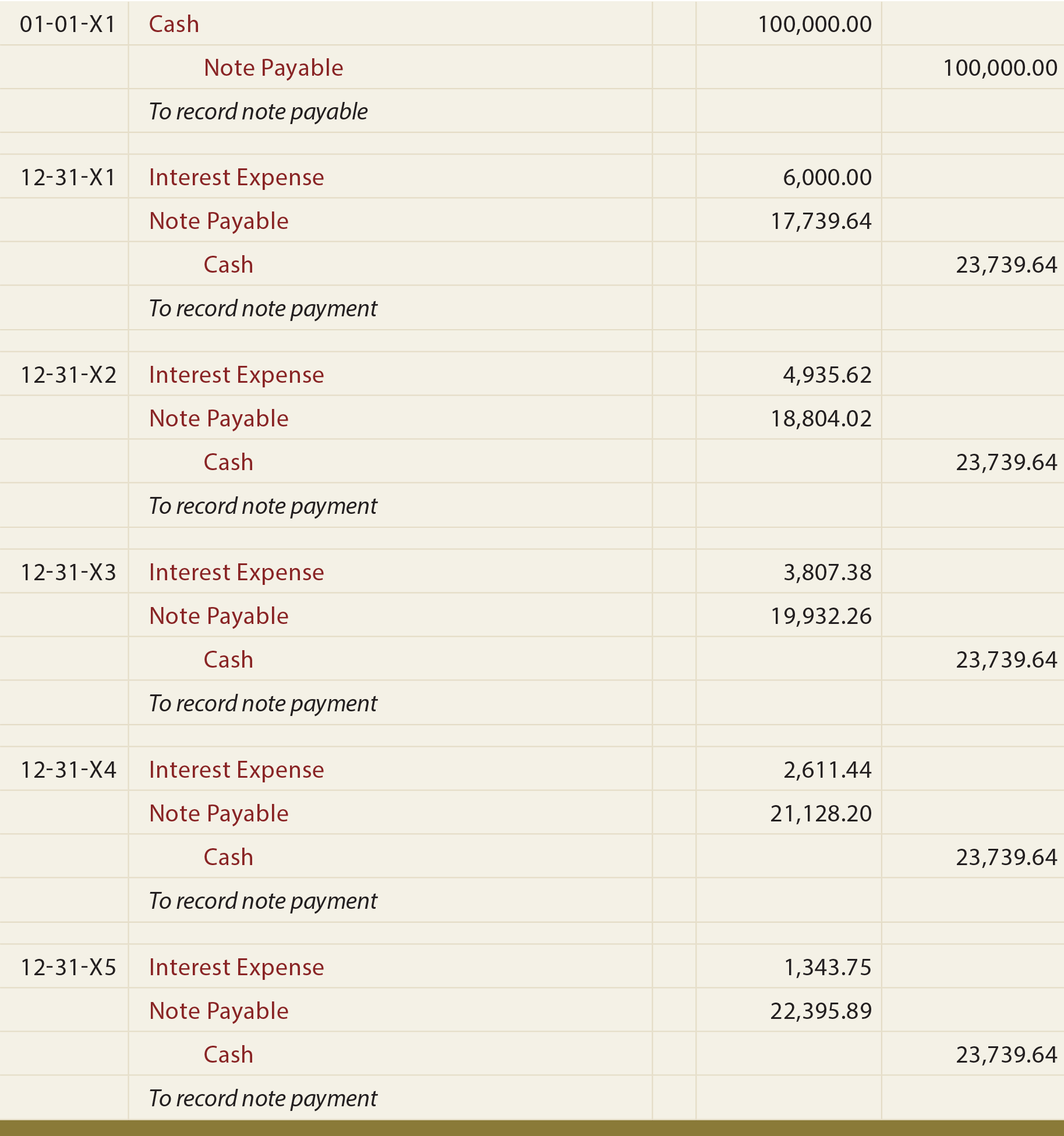

These car journal entries are for a vehicle costing 15000 and for a loan of 5 years at 12 with fortnightly payments calculated using the same Loan Amortization template mentioned above. When Borrower repays his loan. When Borrower is responsible for paying Interest on Loan.

The journal entries of this loan are as follows. Group of answer choices. The loan is due in 6 months.

Basics of Journal Entries Accounting Journal Entry Examples. Here are numerous examples that illustrate some common journal entries. This problem has been solved.

They can be obtained from banks NBFCs private lenders etcA loan received becomes due to be paid as per the repayment schedule it may be paid in instalments or all at once. So for knowing actual balance of loan outstanding we need to pass journal entries. Incurs liability to pay the loan amountand org.

Assignment of accounts receivable is an agreement in which a business assigns its accounts receivable to a financing company in return for a loan. The Journal Entry for the loan received is. Post Journal entry at the time of loan received.

Increase Liability Assuming that the money was. Borrowings balance increases by 10000. Journal entries for borrowing cost capitalisation.

When Borrower pays the interest to Lender. Journal Entry for Loan Payment Principal Interest Loans are a common means of seeking additional capital by the companies. Following is the journal entry for loan taken from a bank.

Whenever loan is taken from the bank by an business enterpriseorg.

Journal Entries Of Loan Accounting Education

Journal Entry For Loan Taken From A Bank Accountingcapital

Term Loan Journal Entries Emi Entries Loan Entries

Prepare Journal Entries To Record Short Term Notes Payable Principles Of Accounting Volume 1 Financial Accounting

Loan Repayment Principal And Interest Double Entry Bookkeeping

Solved Problem 13 1 Bank Loan Accrued Interest L013 2 Chegg Com

Equipment Purchase Via Loan Journal Entry Double Entry Bookkeeping

Journal Entries Meaning Format Steps Different Types Application Example Advantages Accountancy

Journal Entries Of Loan Accounting Education

Long Term Notes Principlesofaccounting Com

Notes Payable Principlesofaccounting Com

Journal Entry For Loan Taken From A Bank Accountingcapital

Secured Borrowing Exercise Ppt Download

Long Term Notes Principlesofaccounting Com

Changes To Accounting For Repurchase Agreements The Cpa Journal

Loan Note Payable Borrow Accrued Interest And Repay Principlesofaccounting Com

Assignment Of Accounts Receivable Definition Journal Entries Example

0 comments:

Post a Comment